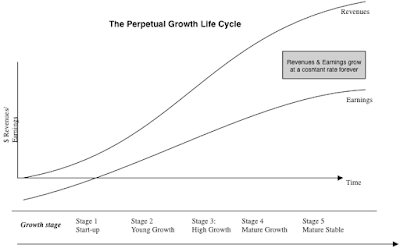

In my last post, I started off by providing a rationale for a terminal value and presented alternatives to the perpetual growth model. That said, most DCFs are built with the the perpetual growth equation, setting up for a potential valuation disaster. Mathematically, the denominator is a powder keg waiting to blow, since as you increase g, holding the cash flow and r constant, your value will approach infinity before turning negative, leading to what I call âBuzz Lightyearâ valuations.

The Growth Cap

If you want to draw on the perpetual growth equation, either because you believe your business will last forever or for convenience, the growth rate that you can use in it is constrained to be less than or equal to the growth rate of the economy in which you operate. This is not a debatable assumption, since it is mathematical, not one that owes its presence to economic theory. Within this statement, though, there are estimation choices that you will have to face about how to define the growth cap.

The Growth Cap

If you want to draw on the perpetual growth equation, either because you believe your business will last forever or for convenience, the growth rate that you can use in it is constrained to be less than or equal to the growth rate of the economy in which you operate. This is not a debatable assumption, since it is mathematical, not one that owes its presence to economic theory. Within this statement, though, there are estimation choices that you will have to face about how to define the growth cap.

- Domestic versus Global: As a cap, you can use the growth in the domestic economy (if your company will remain a purely domestic operator) or growth in the global economy, and the economyâs growth rate has to be computed in the same terms that you are using for the rest of your valuation. That may seem to give you license to use high growth rates for emerging market companies but I would suggest caution, since emerging market economies as they get bigger will tend to see their growth rates move towards a global growth rate. Thus, while it is true that the Indian and Chinese economies have higher real growth rates than the global economy in the near term (5-10 years), they will see their growth rates converge on the global average (closer to 2%) sooner rather than later.

- Real versus Nominal: In an earlier post, I argued that one of the hallmarks of a well-done DCF is consistency in how cash flows are defined and discount rates are computed. Specifically, you can choose to estimate your cash flows in real terms or nominal terms, with the former reflecting growth without the helping hand of inflation and the latter inclusive of it. If your valuation is in real terms, the cap on your growth rate will be the real growth rate in the economy, and if in nominal terms, it will be the nominal growth rate.

- Currency: If you choose to do your valuation in nominal terms, you have to pick a currency to denominate your cash flows in, and that currency will have an expected inflation component attached to it. The nominal growth rate cap will have to be defined consistently, with the same expected inflation built into it as well. Thus, if you are valuing your company in a high-inflation currency, your nominal growth rate forever can be much higher than if you value it in a low-inflation currency.

What if your company is in a high growth sector or a high growth market? The answer lies in the "forever", since no sector or market, no matter how high its growth is right now, can continue to grow at a rate faster than the overall economy forever. One of the greatest perils in valuation is ignoring the growth cap, either because you forget the mathematical basis for why it exists in the first place or because you have mismatched your cash flows and your discount rate, perhaps estimating the former in a high inflation currency and the latter in a low-inflation one or vice versa.

A Risk Free Rate Proxy?

If you accept the rationale that growth is capped at the growth rate of the economy, you are now confronted with a daunting and perhaps impossible task, i.e., to value an individual company, you will now have to estimate expected growth rate in the economy (domestic or global) and expected inflation in the currency of your choice. I, for one, want no part of this estimation challenge, for two reasons. The first is that I find long term macroeconomic forecasting to be a futile exercise and have absolutely no faith in either myself or the institutional entities that claim to be good at this task. The second is that any time I spend on these macroeconomic forecasts is time that I am not spending on understanding my company and its business, key to valuing that company. Consequently, I use a simpler and more easily observable number as a cap on stable growth: the risk free rate that I have used in the valuation. Not only does this take into account the currency automatically (since higher inflation currencies have higher risk free rates) but it is reasonable to argue that it is a good proxy for the nominal growth rate in the economy. Since it is the component of my valuations that I am taken to task most frequently about, I have three arguments to offer and while none standing alone may be persuasive, you may perhaps accept a combination of them.

1. An Empirical Argument:

To understand the link between the risk free rate (a nominal interest rate) and nominal economic growth rates, consider the following decompositions of both:

1. An Empirical Argument:

To understand the link between the risk free rate (a nominal interest rate) and nominal economic growth rates, consider the following decompositions of both:

Risk free rate = Expected Inflation + Expected real interest rate

Nominal economic growth = Expected Inflation + Expected real growth rate

The table below the risk free rate in US dollars (measured with a ten-year treasury bond rate) and nominal economic growth (the sum of expected inflation and real GDP growth) from 1954 to 2015 in the United States, broken into two sub-periods.

| Period | 10-Year T.Bond Rate | Inflation Rate | Real GDP Growth | Nominal GDP growth rate | Nominal GDP - T.Bond Rate |

|---|---|---|---|---|---|

| 1954-2015 | 5.93% | 3.61% | 3.06% | 6.67% | 0.74% |

| 1954-1980 | 5.83% | 4.49% | 3.50% | 7.98% | 2.15% |

1981-2008 | 6.88% | 3.26% | 3.04% | 6.30% | -0.58% |

The nominal GDP growth rate was about 0.74% higher than the risk free rate over the entire period (1954-2015), but it has lagged the risk free rate by 0.58% since 1981. I know this table, by itself, proves nothing, but there is reason to heed to the link. In the last few sixty years in the United States, nominal interest rates and nominal growth have been closely tied to each, with an increase in one tied to an increase in the other. It is true that there is evidence in the data, especially in the 1954-1980 time period, that real growth can exceed real interest rates for extended periods, and economic intuition provides a rationale for why. If those who take no risk earn the riskfree rate, the economy, at least on average and over long time periods, has to deliver a little bit more to reward the risk takers. However, not only can that differential not be a large number but it is also worth remembering that the nominal growth rate is the growth rate in the entire economy, composed of both mature and growth companies. If you allow every mature company to grow at the rate at which the economy is growing, what does the growth come to sustain the growth companies in the economies? Put differently, setting the growth rate for mature companies below the growth rate of the economy cannot hurt you but setting it above that of the economy can cause valuations to implode. I'll take my chances on the former!

2. A Consistency Rationale

If you are not convinced by this reasoning, I will offer another reason for tying the two numbers together. When you use a riskfree rate in a valuation, you are implicitly making assumptions about economic growth and inflation in the future and if you want your valuation to be consistent, you should make similar assumptions in estimating your cash flows. Thus, if you believe, the risk free rate today is too low or even negative (because the central banks have kept it so), and you use that risk free rate to come up with your discount rates, you have to keep your growth rate in perpetuity very low or negative to keep your valuation from imploding. That is the point that I was making in my post on negative interest rates. In the last decade, as interest rates have hit historic lows, the danger of this mismatch has become greater. Analysts have been quick to shift to using the lower risk free rates (to 2% or lower) in their discount rate calculations while continuing to use nominal growth in the US economy (5-6%) as the cap on their growth rates. That is a recipe for disaster!

3. A Self-Control Basis

There is a third and final reason and this may reflect my personal weaknesses. When I value companies, I know that I fight my preconceptions and the urges I feel to tweak the numbers to deliver the result that I want to see. There is no number that can have more consequence for value than the growth rate in the terminal value and having a cap on that number removes the most potent vehicle for bias in valuation.

In sum, you may or may not be convinced by my arguments for capping the perpetual growth rate at the risk free rate, but I would strongly recommend that you create your own cap on growth and tie that cap to the risk free rate in your valuation. Thus, you may decide a looser version of my cap, allowing your perpetual growth rate to be as much as (but not more than) one percent higher than the risk free rate.

Conclusion

The perpetual growth model is a powerful device for applying closure in a discounted cash flow valuation but it is a mathematical honey trap, with the growth rate in the denominator acting as the lure for analysts who are inclined by bias or ignorance to play with it. If you are tempted, it is worth also remembering that it is the first place that that people who are well versed in valuation look to check for valuation ineptitude, since there are far more subtle ways to bias your valuations than playing with the growth rate.

YouTube Video

2. A Consistency Rationale

If you are not convinced by this reasoning, I will offer another reason for tying the two numbers together. When you use a riskfree rate in a valuation, you are implicitly making assumptions about economic growth and inflation in the future and if you want your valuation to be consistent, you should make similar assumptions in estimating your cash flows. Thus, if you believe, the risk free rate today is too low or even negative (because the central banks have kept it so), and you use that risk free rate to come up with your discount rates, you have to keep your growth rate in perpetuity very low or negative to keep your valuation from imploding. That is the point that I was making in my post on negative interest rates. In the last decade, as interest rates have hit historic lows, the danger of this mismatch has become greater. Analysts have been quick to shift to using the lower risk free rates (to 2% or lower) in their discount rate calculations while continuing to use nominal growth in the US economy (5-6%) as the cap on their growth rates. That is a recipe for disaster!

3. A Self-Control Basis

There is a third and final reason and this may reflect my personal weaknesses. When I value companies, I know that I fight my preconceptions and the urges I feel to tweak the numbers to deliver the result that I want to see. There is no number that can have more consequence for value than the growth rate in the terminal value and having a cap on that number removes the most potent vehicle for bias in valuation.

In sum, you may or may not be convinced by my arguments for capping the perpetual growth rate at the risk free rate, but I would strongly recommend that you create your own cap on growth and tie that cap to the risk free rate in your valuation. Thus, you may decide a looser version of my cap, allowing your perpetual growth rate to be as much as (but not more than) one percent higher than the risk free rate.

Conclusion

The perpetual growth model is a powerful device for applying closure in a discounted cash flow valuation but it is a mathematical honey trap, with the growth rate in the denominator acting as the lure for analysts who are inclined by bias or ignorance to play with it. If you are tempted, it is worth also remembering that it is the first place that that people who are well versed in valuation look to check for valuation ineptitude, since there are far more subtle ways to bias your valuations than playing with the growth rate.

YouTube Video

DCF Myth Posts

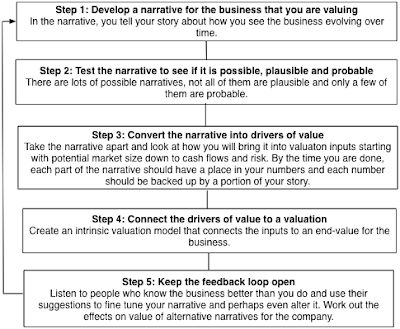

Introductory Post: DCF Valuations: Academic Exercise, Sales Pitch or Investor Tool

- If you have a D(discount rate) and a CF (cash flow), you have a DCF.

- A DCF is an exercise in modeling & number crunching.

- You cannot do a DCF when there is too much uncertainty.

- It's all about D in the DCF (Myths 4.1, 4.2, 4.3, 4.4 & 4.5)

- The Terminal Value: Elephant in the Room! (Myths 5.1, 5.2, 5.3, 5.4 & 5.5)

- A DCF requires too many assumptions and can be manipulated to yield any value you want.

- A DCF cannot value brand name or other intangibles.

- A DCF yields a conservative estimate of value.

- If your DCF value changes significantly over time, there is something wrong with your valuation.

- A DCF is an academic exercise.